Mohit's Mentor Club Project | CRED

about CRED

CRED is a lifestyle-based fintech focusing on the top 1% (actually 3%) of India’s population. this was based on kunal shah’s understanding of the top population basis the passenger car owners or credit card users, about 50 million of them.

started from being a credit card bill payment service, CRED has evolved into a premium fintech providing access to low interest loans, payments, credit card management, financial analysis, vehicle management services, and rewards through other lifestyle programs with store and escapes (luxury trips).

building on their ‘premium’ ideology, they have targeted users with a good credit score (more than 750) and have positioned themselves as a members only club (just the way GrowthX does). lastly, CRED is looking to build more products and services that help their target audience, with the goal of monetising its users as they near the habituation phase.

for reference, here’s the wealth pyramid they’re gung ho for.

questionnaire

goal: to understand the users lifestyles in order to embed CRED's services

approach: understanding their psychographics and preferences by delving deep into the user's financial habits

demographics and psychographics

- name, gender, and age

- education, and occupation (and industry)

- relationship status, location (place of stay) and who they live with

- income bracket and sources of income

- devices used (iOS or android, macOS or windows)

- where do you spend your time?

- what platforms do you use and what kind of content do you consume?

- what are the payment modes you use? (understanding the financial instruments used)

- what all subscriptions do you have?

lifestyle

- how much do you spend monthly? how much of it is from credit cards?

- what are things you'd want to buy? how frequently do you shop and where do you shop from? are there specific brands you love?

- what all purchases are driven by your partners? what do they do in their day? (understanding their influencers and blockers)

- what are your top spends on credit cards? (basis monthly, quarterly, and yearly)

- what do you value more, time or money?

- do you drink? what brands do you drink from frequently? what is the brand you'd want to drink? (understanding lifestyle upgrade preferences, i.e., from red to black to blue label)

- how frequently do you travel

credit worthiness

- how may credit cards do you own?

- what are the kind of credit cards you own? (understanding the card level, i.e., premium cards share)

- what types of credit cards do you use? (e.g., rewards, travel, cashback, utilities)

- do you track your spends and purchases timely?

- what is your credit score? (specifically, experian score)

finance apps

- list down all the finance apps you use?

- are you specifically using these for a motive, if so, what's that?

- how did you discover the apps that you use currently? how did you go about choosing the one that you did?

- what aspect of your current app is more important to you? (options include ease of use, support, integration with multiple accounts, etc.)

- on a scale of 1-5 (5 being the highest) how would you rate the trust on the apps that you use?

- how do you stay in touch with current trends and updates by these apps?

CRED's impression

for potential users

- have you heard about CRED before?

- what do you think CRED offers?

- what would make you switch to CRED?

- is there any hesitation with choosing CRED currently, if so, what?

- do you think you can benefit from CRED if you switch to it?

management of credit

- how do you manage your credit cards usually?

- what were the sources of management before CRED? (current and churned users)

- what has been incrementally better post CRED? (current and churned users)

about CRED

acquisition specific

- how did you discover CRED?

- what made you try CRED? were there other services you considered exploring before trying CRED? (understanding the value-prop perceived and competition)

onboarding specific

- how easy was to be onboarded onto the platform?

- was the process to link your cards and accounts easy?

- were there any confusion points during the onboarding? (considering it to be an exclusive club)

- is there something you hoped for that would've made this experience better? (options include adequate support, walkthrough, multiple steps, information, simpler onboarding with less details, others)

engagement and retention specific

- what problems has CRED solved for you?

- what is your most used feature on the app? (extension: what is the most important feature for you currently?)

- how frequently do you interact with CRED?

- what are the services you use on the platform? (options include upi, card management, store, garage, escapes, money, mint, etc.)

- do you use CRED coins? how valuable are they for you?

- good(s) and the bad(s) about CRED?

- is there something that you aren't able to find on the app?

- why did you leave CRED? anything that would make you come back to the app? (for churned users)

- what are features that might make you engage more / bring your back on CRED?

- how is / was your experience with the app?

monetisation specific

- if CRED starts charging you for the services they provide, would you consider paying for it?

- what would you be willing to pay for, and how much?

- have you considered other apps that you might shift to possibly?

- what is one thing that you innately believe CRED provides you value for?

escapes

- how frequently do you travel in a year?

- how many of those are leisure trips?

- how many of those are foreign trips?

- what kind of hotels do you stay in?

- what does a typical leisure travel entail for you? how many days is it typically for?

- how much do you specifically spend for your trip? how does the split look like across categories?

- have you explored escapes on CRED?

- how was your experience like? what extras did you get from your travel?

summary

- is there anything you'd want to share in general?

- any pain points you go through when it comes to finances and money?

icp(eace)

note: i spoke to ~8 users of CRED for devising the icps based on the personas that came more frequently (and were prioritised)

icp name | demographics and psychographics | their story | major pain points | what do they love CRED for? |

|---|---|---|---|---|

aisha |

| aisha is in her first job in bangalore and graduated recently. she loves everything premium and classy and is loves to be a part of "exclusive" areas. she wants to build a good credit history, earn rewards and learn more about credit and financial planning. she uses CRED as it allows her to do so. she saves up for those big purchases every month and loves attending events and keeping up with the new trends that come along. before CRED she was using multiple cluttered platforms like paytm and phonepe, and CRED helped her brag while making the experience 10x better. |

|

|

ahaan |

| ahaan is a mid to high experienced 28 year old who lives with his wife in mumbai. he is a dink couple and has a premium lifestyle with house in worli and going out to bastian for dinners. he is always on the lookout for new experiences while being able to manage his finances decently well. he craves for that extra help with his finances and being able to not think a lot about the same. he works at zepto and is always on the hunt to upskill himself so that he can open a startup of his own someday. apart from his wife and work, he spends a lot of time listening to podcasts and CRED fairly fits into his lifestyle. by the way, he wears a birkenstock (not just because steve jobs did so too, but also to be a true startup bro) |

|

|

arya |

| arya is a freelance consultant who keeps travelling the world, for a fact, she's visited over 30 of them. she is in a long distance relationship and is quite scared of managing her bills and card due to the hectic days she has. she is a borderline gen-z and loves to keep up with fashion, trends, new apps in the market. because of her hectic life, she watches shows on 2x, just so she can catch up with the world, however, when it comes to her finances, she works on 0.25x because it's daunting. lastly, she loves the extra rewards and hence is a CRED user. |

|

|

growth goal

improve new user acquisition by 30% (increase 3.5 million) in the next 12 months! (more about their new user problem here)

current run rate: 13 million users over the past 18 months

sub-lever

overview

insights

basis the user calls and the market research done, these were a few insights received into travel patterns:

- foreign travel has increased 4x in the last decade and about 380 million international travels take place every year (source)

- more than 50% of lrs is being contributed through foreign travel, about $17 billion annually (source)

- funds and monetary compliance is the most common reason for rejection of visas (source)

- CRED's icp travels to at least 1 international destination every year (basis user calling insights)

icps targeted

in order of priority of targeting users,

- arya - arya, a frequent traveller for work and otherwise is a modern-nomad that works from anywhere or frequently travels for work visiting more than 3 countries every year

- ahaan - ahaan, a startup bro, has sufficient funds in order to make an international travel and does about 2 trips annually

- aisha - aisha, a first job employee, who wish to study abroad, go for a trip with friends or look for 'travelling the world' are use cases to target as needs arise

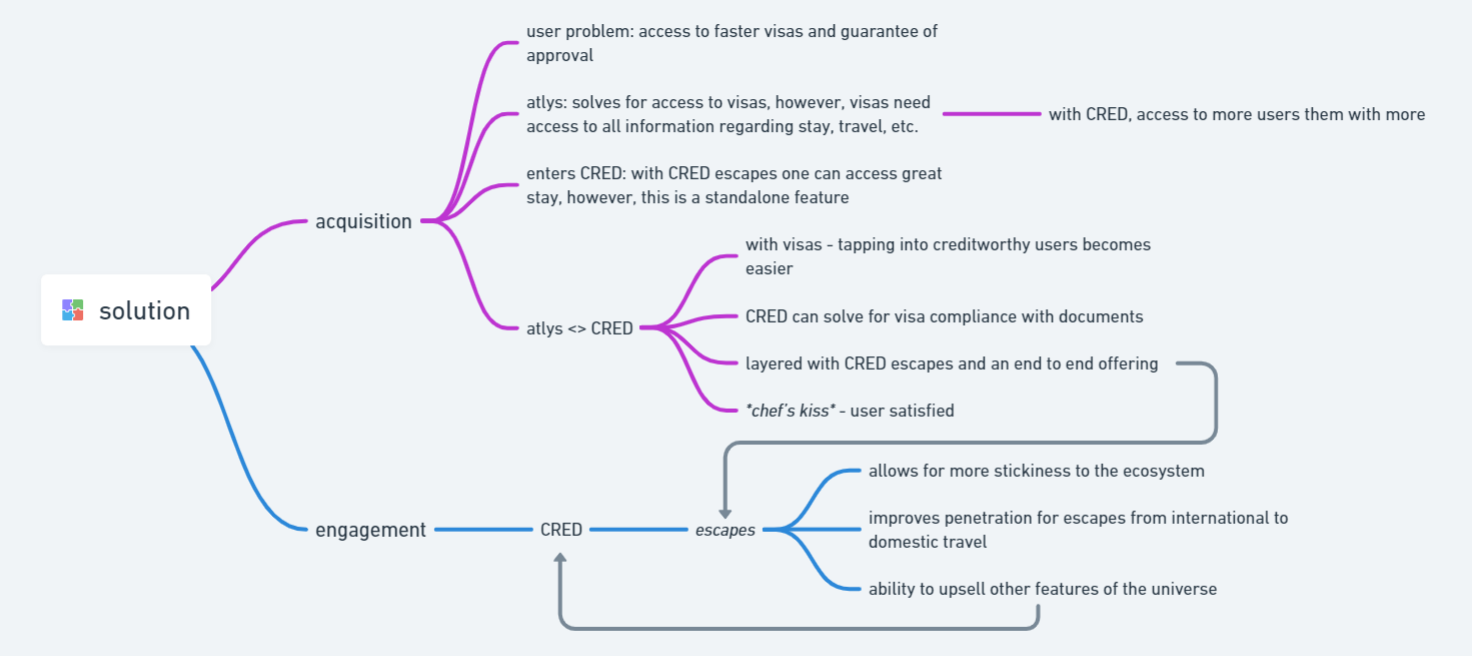

sub-lever and rationale - why integration?

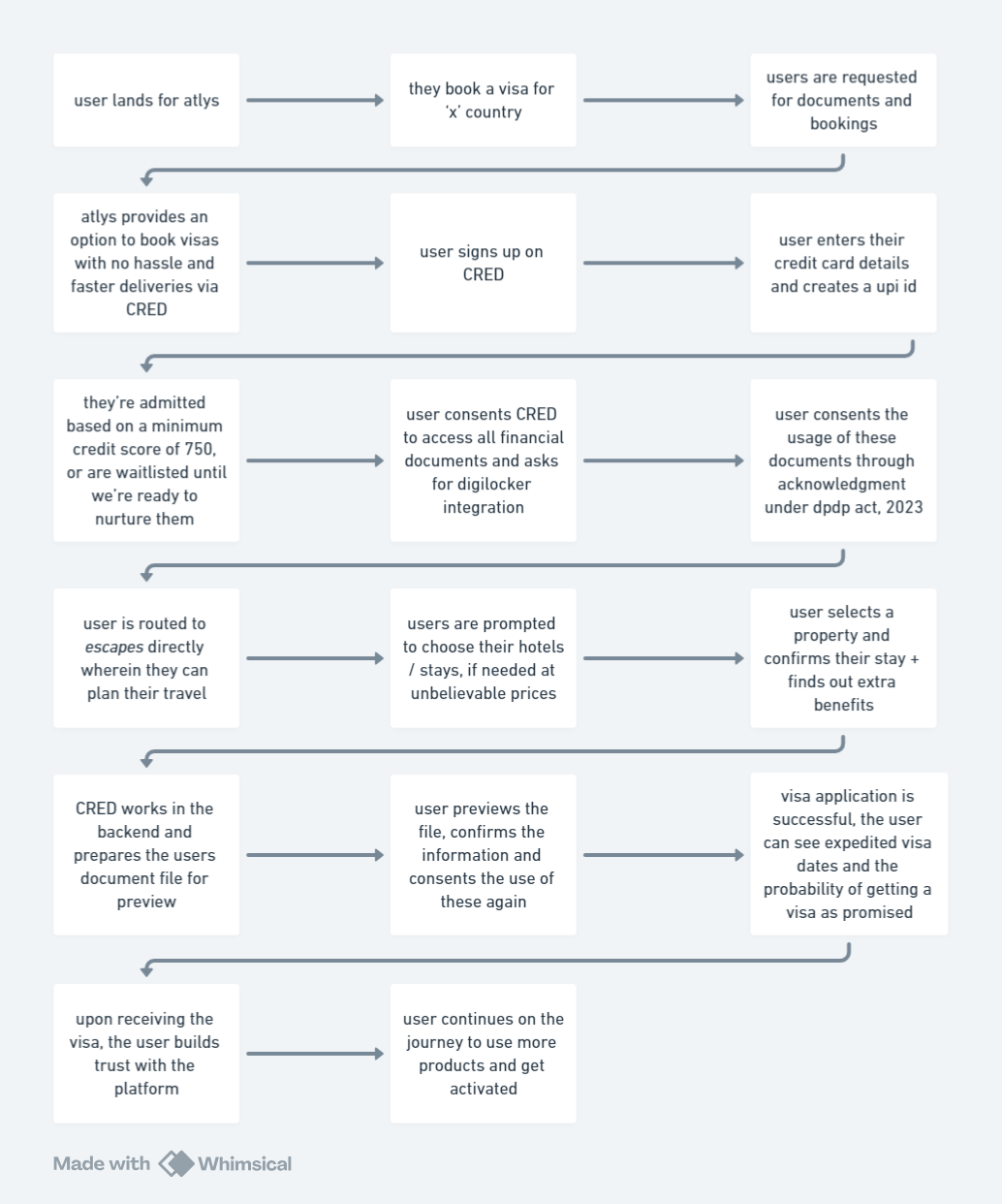

the idea is to do a product integration of atlys with CRED, wherein new users who are looking to travel internationally can access a whole host of services from through CRED, while also engaging its existing users. rationale behind the same is detailed below:

for users | for CRED | for atlys |

|---|---|---|

|

|

|

why atlys?

- founded recently in 2021, atlys is a promising startup in this space garnering ~450k unique impressions every month - about 19k app downloads daily (source: sensortower)

- atlys is a one time use case product (visas on time) and lacks an engagement play, and CRED can provide the engagement play through its offerings

- with the feature embedded to create a holistic escapes' offering it helps atlys access CREDs premium user base

- integration can help CRED acquire new users for building onto their growth playbook, while allowing atlys to serve a larger customer base

- icp overlap is the main reason for this integration because maximum visas issued are on use cases specific to study, travel, and work, and all three are being covered through CRED's icp buckets prioritised accordingly

- brand value fit is high in this integration because of the crema-de-la-creme user experience by seamlessly combining luxury financial management with streamlined visa solutions, aligning with both brands' commitment to convenience, innovation, and global accessibility

solution

- document and compliance is the most common reason for visa cancellations and the embassies do not have more insights on one's finances, apart from the submitted statements like credit scores

- international travellers are more likely to use a new app/service that allows them for a stress free trip planning experience which can lead to faster activations for CRED

- by providing access to a person's credit score, bank statements, and other required documents (sourced from digilocker), CRED can make this process almost automatic (with user consent, data sharing is allowed under dpdp act, 2023 - source)

- through this integration, CRED can almost guarantee a visa to the user segments, i.e., no stress, pure bliss

- CRED escapes is one such product on the platform that allows users to book luxury travel by providing them with a discounted price, opportunities for further cashbacks, and extra benefits, like a champagne on the house - with visas integrated, it is a great opportunity to cross sell its other offerings to new users like credit card management, financial analysis, vehicle management, among others

user journey flow

hypothesis

integrating with atlys allows CRED to access and acquire new users 3x more (assumption: from their current activation rates dropping on day 3 - basis product research) and also build on their engagement play with existing users as they are more likely to use atlys and escapes for their international travel (more ecosystem products being used) and incremental revenue opportunities. with an aha moment in their international travel experience, this will lead to more domestic booking via escapes and this will lead to more stickiness of the CRED ecosystem

expanded user acquisition

- hypothesis: integration will increase new user acquisition by leveraging atlys’ travel-focused user base

- rationale: access to atlys' network will attract users interested in premium travel and financial management

increased engagement and incremental revenue

- hypothesis: existing users will more frequently use atlys for visas coupled with escapes

- rationale: easier access to visa services will boost usage of CRED’s escapes and other premium offerings like foreign card usage and financial analysis

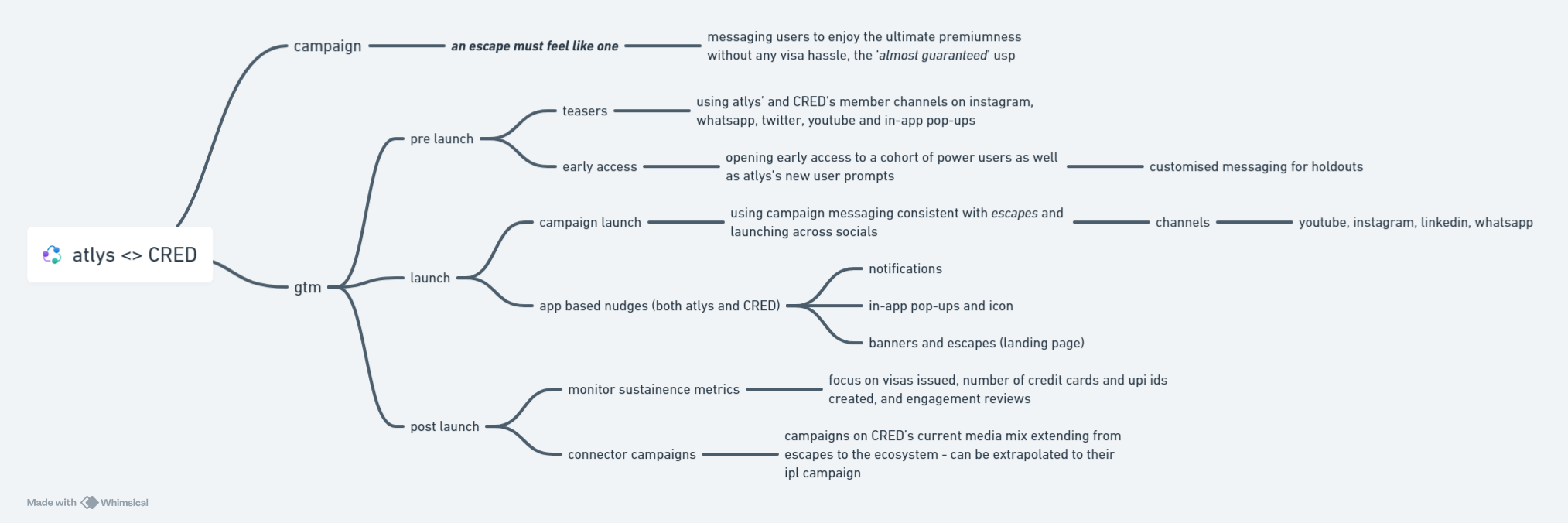

roll out plan

pre-launch phase (m0 to m3)

activity | details | timeline |

|---|---|---|

technical integration | developing and testing the integration of atlys' button, escapes section, and in-app banners | m0 to m3 |

design and ui/ux | creating designs and mockups along with a CRED user trail for atlys and escapes (international properties) | m0 to m2.5 |

content creation and campaign design | creating the campaign design "an escape should feel like one" and promotional content for the same | m1 to m2 |

advertisements | piloting campaigns to power users to see initial reactions on the app | m1 to m3 |

launch phase (m3 to m5)

activity | details | timeline |

|---|---|---|

soft launch | expanding the test launch to all power users on the platform along with waitlisting enthu cutlets | m5 |

marketing campaigns | full fledged roll out of the escapes campaign while also launching pop-ups on atlys and their socials | m3 to m5 |

user feedback | in-app nudges to gather feedback from existing users and new users cohortised by atlys | m4 to m5 |

expanding access and iterations | iterating on the feedback and expanding access to more users, i.e., customised journey | m4 to m5 |

post-launch (m5 to m12)

activity | details | timeline |

|---|---|---|

full launch | launching across all target groups of atlys and CRED and other potential users in the market | m6 to m7 |

optimising offerings | basis feedback and performance data, optimising flows, bundling and explore intent of the integration on the app to improve completions / bookings | m5 to m7 |

marketing | continue ongoing campaigns and scale further with paid channels | m5 to m12 |

engagement and tracking | tying it to CREDs universe and tracking habit metrics of users | m6 to m12 |

gtm

potential risks and mitigation

- tech integration to user experience

- will be mitigated through a phased approach with limited access and a dedicated support team to handle grievances

- lower adoption of the feature

- will be mitigated through cohortised targeting and retargeting through paid ads, offering higher rewards and iterations

- brand alignment

- will be mitigated through better alignment of value prop and messaging, and a seamless in app experience

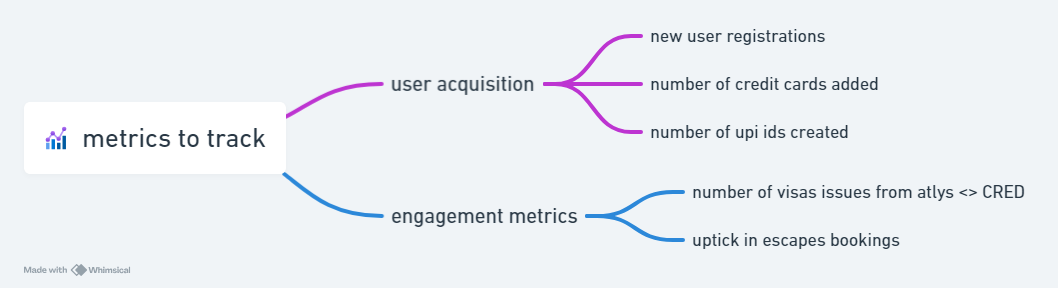

metrics to track

impact analysis

for achieving the initial set goal of 50% increase in new user acquisitions in the next 12 months, it essentially adds ~3.5 million users to the platform

metric | pre-integration (assumptions fared in) | post-integration (expected) | impact |

|---|---|---|---|

new user registrations | 13 million in 18 months | +30% increase (3.5 million) in 12 months (6 month advantage) | increased user base through streamlined visa application process |

activation rate | 25% (assumption) | +30% to 32.5% | faster and higher onboarding due to integrated services |

feature usage | 20% | +40% to 28% | increased engagement with atlys integration features |

escapes utilisation | 10% | +50% to 15% | higher usage of CRED’s travel-related services due to integration - also better assistance with stay mandates needed as proofs in documentation |

revenue impact | INR 570 (annually) | +20% to INR 684 (annually) | incremental revenue from upselling and increased bookings |

cac | INR 500 | -30% to INR 350 | reduced cost per acquisition due to more efficient user onboarding and engagement |

user feedback + nps | 3/5 (blended) | +16.67% to 3.5/5 overall | improved perceived value and feedback iteration for higher satisfaction |

by the way, this was kunal's moonshot idea in 2019, executable as listed above. (watch the video here)

fin.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.